Webinar Series: Digital Transformation

Digital Hustlers: Digital Marketing 101 in 90 Minutes | General Assembly Malaysia

Wednesday, 16 June 2021

2.30 p.m. - 4.30 p.m. (MY Time)

|

Step into the world of digital marketing with General Assembly Malaysia and see the strategies that drive today’s biggest brands. In this introductory session, we will cover the fundamentals of digital marketing, and introduce you to the key channels, concepts, and metrics. This includes exploring the components of brand building and see how modern marketers drive successful campaigns using content, email, social media, paid advertising channels, and more. Speaker’s Profile

Registration Fee: MII Members (Individual/Institutional) – Complimentary Non Members: RM 50.00 |

Naadira Zulkifli,

Digital Marketing Instructor

/Teaching Assistant,

General Assembly Malaysia

and Digital Marketing Lead,

Sedania Innovator

Cyber Incident Response

Friday, 11 June 2021

3.30 p.m. - 4.45 p.m. (MY Time)

|

This webinar session gives a general overview of Incident Response Management and the challenges faced by an Incident Manager during remediation. Speaker’s Profile Chris Zietsman, Registration Fee: MII Members: Complimentary Non Members: RM 50 (USD15) |

Chris Zietsman,

Cyber Manager - Australia

Charles Taylor Adjusting

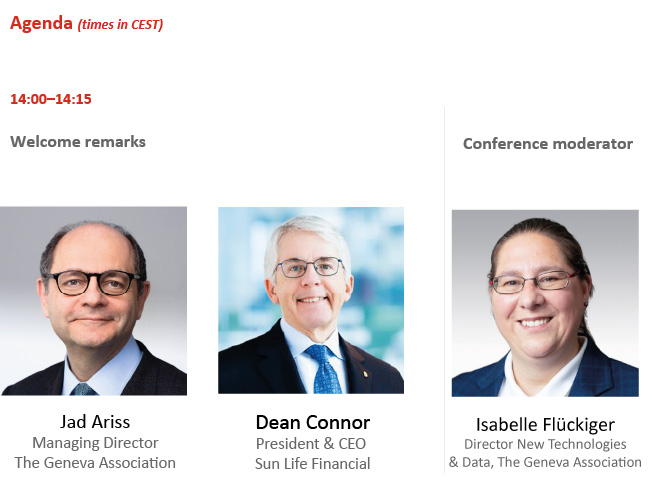

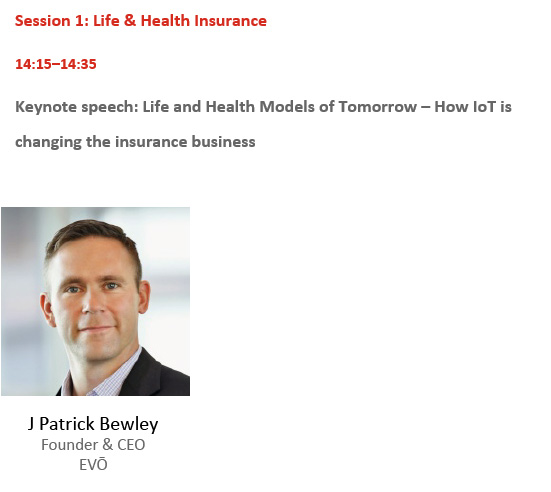

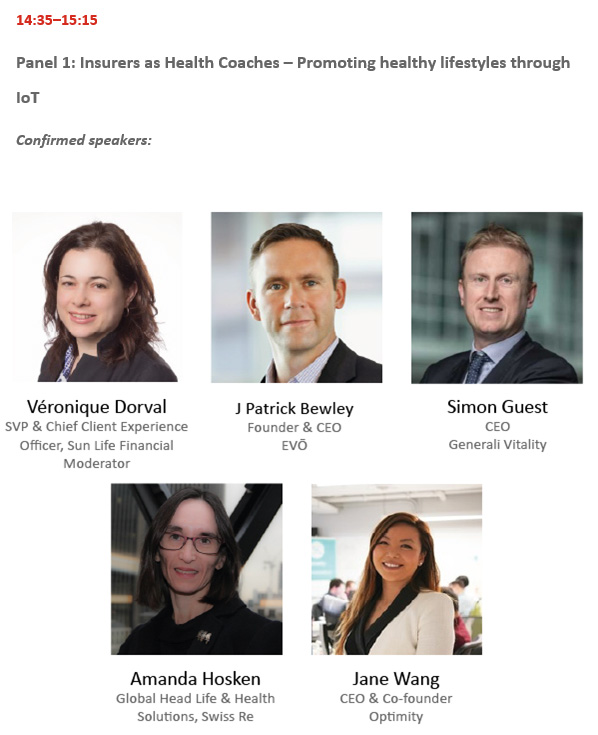

New Technologies & Data Conference 2021

From Risk Transfer to Risk Prevention - How IoT is reshaping business models in insurance

Tuesday, 1 June 2021

14:00–16:30 CEST / 8:00–10:30 EDT

|

We are pleased to invite you to the inaugural New Technologies & Data Conference, taking place virtually on Tuesday, 1 June 2021 and co-organised with Sun Life Financial. Discussion overviewThe amount of data being generated globally – much of it in real time – is increasing, fuelled by the expansive use of sensors and smart devices in almost all areas of life. A key driver of this development is the Internet of Things (IoT). For insurance companies, such data can provide valuable insights, with the potential to predict and prevent risks. |

New Technologies & Data Conference 2021

Cyber Terror and Cyber War: Towards consensus on language and attribution

Monday, 19 April 2021

2.00 p.m.–3.15 p.m. CEST / 8.00 a.m.–9:15 a.m. EDT

Join us for our next #RiskConversations webinar on two recent Geneva Association reports dealing with cyber risk and insurance.

The COVID-19 pandemic has underscored for insurers the importance of linguistic clarity in policy wordings to avoid ambiguity and its potential consequences: litigation and reputational damage. In the cyber realm specifically, the re/insurance community would benefit from common language to define cyber events, as well as a common approach to attributing them. This would make it possible for industry to holistically assess their risk exposure, promoting the insurability of cyber risks.

These are the issues addressed in two recent reports by The Geneva Association and the International Forum of Terrorism Risk (Re)Insurance Pools (IFTRIP) Cyber Terrorism and Cyber Warfare Task Force.

Join us for this Risk Conversations webinar with task force members and cyber experts, who will present the key takeaways of the reports and address pressing cyber concerns for insurers:

- Proposed language to describe cyber acts that fall in-between cyber terrorism and cyber war

- How the industry can collaborate to optimise existing processes for attribution and characterisation

- Potential for cross-sector collaboration as well, towards developing international norms around attribution

Insurer capacity to absorb related losses and help close cyber protection gaps

Risk Conversation Webinar Series

Accelerated Digital Transformation of Legacy Companies

Thursday, 25 March 2021

3.00 p.m. - 4.00 p.m.

Digital transformation has truly become a buzzword in recent years. But what does it really mean? And how do companies implement it?

Steffen Damborg will present fascinating cases of digital disruption based on his extensive experience and new research from Harvard Business School. Audiences will learn how companies and societies can cope with the new challenges and how to take advantage of “the new rulebook”, focusing on the new opportunities in a more proactive manner.

Digital Transformation Strategist,

Board Member, Keynote Speaker, Denmark

ICDM Powertalk Series

Acceleration of Digital Businesses and the Rise in Commercial, Specialty and Cyber Insurance Demand

Thursday, 25 February 2021

12.00 p.m. Eastern Standard Time

While specialty and cyber insurance had seen growth the last few years, the disruption of 2020 has accelerated that demand. All businesses, both large and small, are accelerating their digital transformation by changing their business models, products and services to meet new customer expectations. Just look at the rise in online shopping in the last year. In a post-COVID world, many businesses and industries are poised for growth, including e-Commerce retailers, e-Learning, virtual events and meetings, IOT-based products and businesses, virtual restaurants and much more. These businesses will need insurance coverages that may not fit with traditional commercial products, needing specialty and cyber insurance coverages instead. In particular, businesses are looking for cyber insurance solutions to provide protection to their business in a technology and competitive market that is changing faster than ever before.

In this rapidly changing insurance market, new competitors don’t play by the traditional rules of the past. They are looking at innovative new products, expanding channel reach, new partnerships and ecosystems to provide solutions to meet the changing market demand … with speed to market, implementation, and revenue accomplished in weeks or a few months rather than years. As 2021 unfolds, insurers should consider a mix of offensive and defensive plans to position themselves in providing new specialty products and services to meet a new digital business world and capture the opportunity for growth.

Hear from this panel about the unfolding market and growth opportunities and how Hartford Steam Boiler is poised to capture it with new innovative products – in particular cyber insurance – as well as new channels and partners, by leveraging a next generation platform that delivers speed to value.

How to Surf the Digital Transformation Wave with Ease

Wednesday, 24 February 2021

11.00 a.m. (Singapore Time)

Digital Transformation isn't about the technology, it is a strategy for the future of the organisation that encompasses people, process, data and service excellence. There is a major difference between digitization, digital transformation and disruption.

This 60 minute webinar will cover fundamental topics like digital trends and changing digital requirements, functional and useful apps that will boost productivity, as well as basics in social media and digital marketing.

Register now to understand how you can be ready for the organisation of the future!

Brought to you by

Sponsored by

Cyber Security - Tracking the Data

Wednesday, 24 February 2021

11.00 a.m. - 12.00 p.m.

Mr. David Piesse, a renown expert in this area will be sharing his experience and perspective on data integrity in the sphere of cyber security and its application on new products for cyber insurance with data driven underwriting. This session will also discuss on parametric and IOT Insurance. The key focus of the discussion will be on how crown jewel data is tracked for provenance to be anti-tampering and the importance of having a data classification process to identify and track data. David’s article for the International Insurance Society entitled Where Cyber Insurance Meets Cyber Integrity delves deeper on this important topic in light of global developments.

Speaker’s ProfileDavid Piesse, CEO, DP88, specialising in InsurTech initiatives in Asia - www.DP88.com.hk.

Global Insurance Evangelist and Advisory Board member of Guardtime, a leading cybersecurity company and blockchain provider specializing in cryptography for data integrity. Their keyless signature infrastructure (KSI) is utilized across the defence industry and in supply chain, insurance, healthcare and manufacturing verticals. They have an underlying application for data privacy laws such as GDPR. In May 2018 EY, Guardtime and Maersk with members of the insurance industry launched InsurWave, the first global commercial insurance blockchain backed platform to enter production commencing with marine insurance.

Advisory board member of Ultimate Risk Solutions and previous Asia Pacific Lead assisting URS to introduce Risk Explorer in the emerging market and inter operate with new innovations such as InsurWave. As Chairman of the International Insurance Society (IIS) Ambassadors he assists the management introduce new programs to extend membership and introduce localized content.

He has held numerous positions in a 40 year career including Global Insurance Lead for SUN Microsystems, Asia Pacific Chairman for Unirisx, United Nations Risk Management Consultant, Canadian government roles and started his career in Lloyds of London and associated market. He is currently involved in numerous start-ups for exponential technologies for blockchain and AI across multiple vertical industries.

He is an Asia Pacific specialist having lived in Asia for 30 years with educational background at the British Computer Society and the Chartered Insurance Institute. On July 2017 he received the Kenneth Black Jr. Distinguished Service Award from the International Insurance Society.

Registration Fee:

MII Members: Complimentary

Non Members: RM 50.00

Chief Executive Officer, DP88

MII Webinar Series

L&D in a Digital Age

Thursday, 18 February 2021

5:30 p.m. SG / HK Time

Join us for a 75-minute discussion on the importance of learning in the digital age and identify challenges and opportunities of digital learning.

Topic Highlights:

2. What does a digital learner want ?

3. What are strong areas for learning?

4. What are challenges and opportunities of online and digital first learning?

5. How can learning become a lifelong habit for more people?

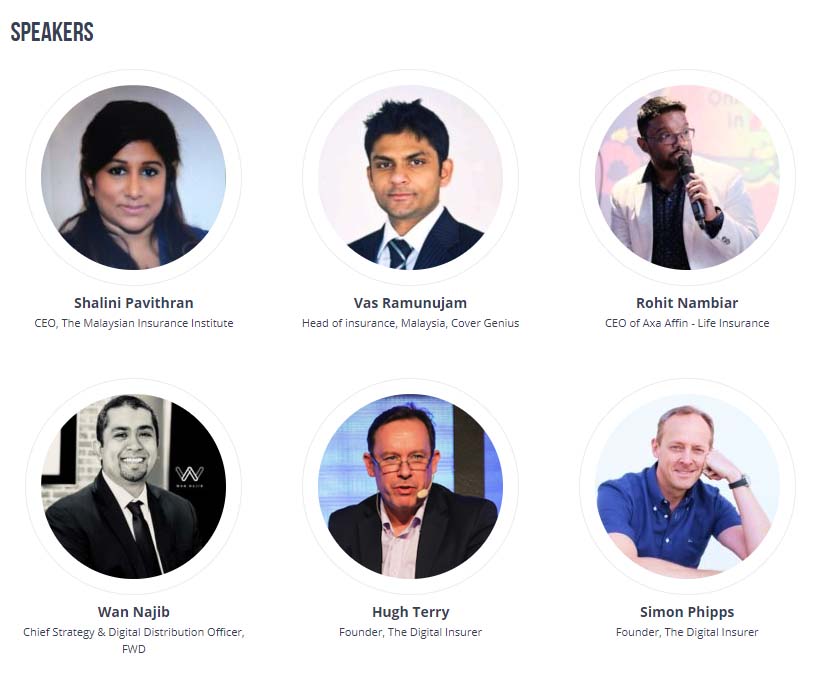

The Digital Insurer Webinar Series

Insurtech : What is it really about and how will it affect me?

Tuesday, 9 February 2021

3.30 p.m. - 4.30 p.m.

Every few days there are new articles about the impact of Insurtech on the insurance industry. How can we, as industry professionals, get a sense of how fast things are really changing? How do we get an overview on the topic without drowning in jargons and codes?

In this webinar, Steve Tunstall will provide a technological overview of Insurtech in simple business language. As a leader in a number of businesses as well as a global influencer in the Insurtech space, Steve has a good sense of how fast things are moving now, particularly in commercial insurance, and what is likely to be coming next. Having spent over 20 years in Asia, mostly in large corporates in South East Asia, Steve will explain the Insurtech space in easy to understand bite-size chunks.

Key takeaways will include the following:

1. An understanding of what Insurtech is and the key drivers of change.

2. Examples of Insurtech companies and challenges facing insurance incumbents

3. Demystifying Technology: What is Blockchain?

4. Sector Deep Dive: Commercial Insurance

5. Future of the insurance industry

Speaker Profile:

Based in Asia for more than 20 years, Steve has over 30 years of experience in owning, running and future proofing companies. He has been CEO, Managing Director, Chairman or equivalent in 12 companies, spanning 4 countries, managing teams of up to 500 employees. Steve has deep domain knowledge in risk, insurance, resilience and compliance.

Amongst other appointments, Steve is currently the:

- General Secretary and Co-Founder of PARIMA.org

Owner of a risk consultancy practice - CEO & Co-Founder of an Insurtech, Inzsure.com

- Director and Head of Risk and Compliance for a fintech, Wadzpay.com

- He sits on the boards of over a dozen companies including captives and ILS Vehicles, of which several are regulated by the Monetary Authority of Singapore with global portfolios.

MII Members: Complimentary

Non Members: RM 50.00

CEO & Co-Founder of an insurtech, Inzsure.com

MII Webinar Series

Accelerating Digital Transformation: Practical Insights

Tuesday, 12 January 2021

1.00 p.m. HK/SGT

The insurance industry has been profoundly impacted by the events of 2020. Digital transformation has become an essential activity to the survival of the business, yet we see many insurers still struggling to meet the aspirations of their clients and distribution partners. Join us as we speak with three insurers to get their insights on this issue and briefly look at a new digital transformation platform which is achieving practical success for insurers.

This 75 minute webinar sponsored and enabled by VERMEG, gives you an opportunity to tap into the experience of a distinguished set of panelists and help get your 2021 transformation program moving in the right direction.

Digital Distribution in P&C: Explore New & Innovative Distribution Channel Options

Wednesday, 16 December 2020

11.30 a.m. EDT

P&C distribution is characterized by a continuously evolving, complex ecosystem. Selecting the right set of partners to enable different aspects of the distribution channel picture is vital for success. The four sponsors of the Digital Distribution Virtual Event represent many critical dimensions of a successful distribution strategy, including agent/carrier connectivity, distribution management, producer and policyholder digital engagement, and affinity/ecosystem partnerships.

This event will include an engaging panel discussion followed by virtual tours from each provider, showcasing their solutions with presentations, videos, demos, and an open forum Q&A. This format allows insurers to effectively and efficiently get a view of the key digital distribution solutions available today. Click here to view the full agenda.

This event is open to insurers only, and registration is complimentary.

CX up AND costs down?

Wednesday, 9/12/2020

12.00 p.m. - 1.00 p.m. (SG/HK)

70% of surveyed APAC insurers see improved customer experience (CX) as a key benefit of modernizing their systems.

Winning in a highly competitive and dynamic APAC insurance market requires a high level of customer-centricity and meaningful differentiation. But, true CX differentiation cannot come from sticking a digital facade on legacy core insurance systems that are slow, costly and difficult to change. Accelerating the shift to digital, Covid-19 has also highlighted the importance of having modernized systems to keep up with the fast-changing customer demands and expectations.

Red Hat recently commissioned Forrester Consulting to conduct a study to understand the state of core system modernization among APAC insurers. Of these 114 surveyed insurers, 85% of them are either embarking on or undergoing modernization efforts.

Join the TDI team and Forrester APAC guest speakers – Fred Giron, VP & Research Director, and YiQin Teow, Market Impact Consultant, as well as Jeff Picozzi, Global Insurance Lead at Red Hat to learn more about how to start your modernization journey to improve process efficiencies AND deliver better customer experiences:

In this webinar, you will:

- Discover how system modernization helps to enhance your customer experience delivery standards

- Understand why system modernization is more than just a technology play, but a crucial factor for the future success of insurers

- Hear about the experiences and challenges that APAC insurance leaders are facing in their modernization journey

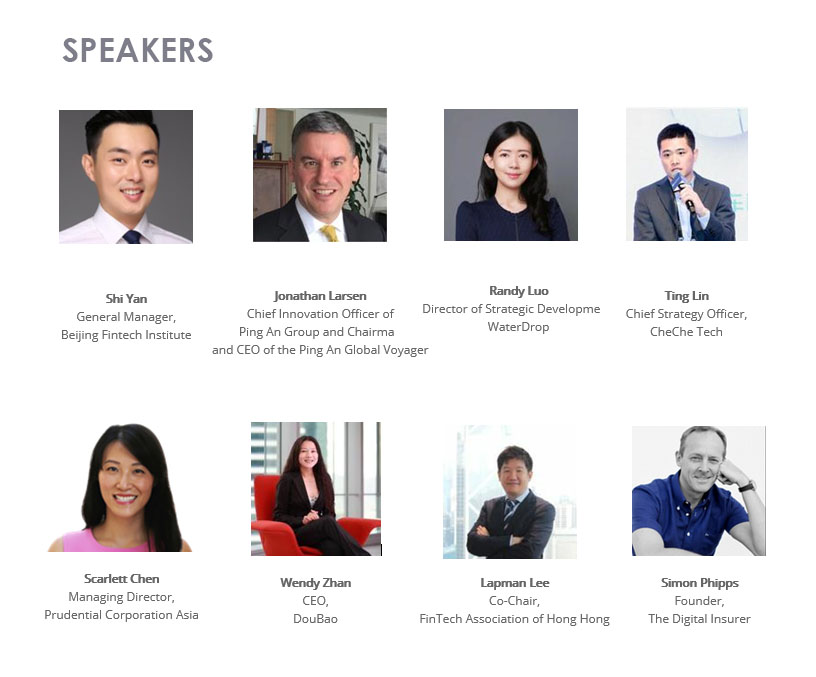

The Rise of China InsurTech - both sides of the wall

Tuesday, 8/12/2020

12.30 p.m. - 2.00 p.m. SG/HK

ITC and TDI have joined together to offer thought leadership on the InsurTech scene in China. Registration is complimentary for this 90 minute event.

The event will tackle issues such as how best to work with InsurTechs as well as showcase some of the InsurTechs working inside and outside mainland China.

Please fill in your details below to register for this virtual event. Upon successful registration you will receive an email invite along with instructions to join the event.

If you are a first-time user, give yourself a little time to download the software to access the virtual event. You may want to enter 5 minutes before the virtual event start to login and make sure everything is working well. If you cannot arrange for a good broadband connection, you may prefer to use the dial in option that is available.

Please refer to our terms and conditions page for full privacy policy.

https://www.the-digital-insurer.com/terms-conditions-tdi-webinars/

The Digital Insurer Webinar

Data Governance:

The Key to Compete in a Digitized Financial Services Market

Wednesday, 18/11/2020

3.00 p.m. SGT / 8.00 a.m. CET

In today’s digital evolution and transformation, scalable and sustainable governance of data is more important than ever. Will the new realities of data governance be a barrier or business opportunity?

In a big-data-fast reality, many financial institutions have to manage hundreds of thousands of data sources, potentially millions of different data sets, and a growing number of self-service users consuming and trying to manage that information.

At the same time, new and more prescriptive data legislation raises many questions on how to govern data in a user-friendly, secure, profitable and compliant way. Thus, it has become essential for every company to review its data governance policies. The handling of data has become a key topic on executives’ agenda.

Regulatory regimes around privacy, such as Thailand’s PDPA and globally the GDPR, HIPAA, GLBA, or CCPA, have put data governance in the news. Other data-related laws concerning security, localization, transfers and sharing of data continue to shape a complex regulatory environment. This trend in the global data market will soon be enhanced with new legislation related to the development and use of artificial intelligence.

Against this background, data privacy has become an important compliance but also strategic consideration for all financial institutions. Data protection programs are setting the foundations for the continuing digitisation of the financial services sector as the data market becomes further regulated.

At this APC live-webinar we will discuss how the financial services sector can embrace the opportunity of digitization by laying robust data governance foundations through sustainable privacy compliance programs. How can financial institutions comply and compete long-term in the increasingly regulated data market thus benefiting from a data-centric approach and the new opportunities with the use of artificial intelligence? How will data governance create a new playing field for FSI?

A top level expert panel will discuss how regulation is driving the digital transformation of the financial services sector, regional and global best practices as well as technology solutions that help meet the challenges and leverage the opportunities.

Key take-aways from this Expert Webinar are:

- – How data privacy has become an important compliance for all financial institutions

- – Date governance as strategic consideration will effect commerce to the max

- – How Data protection programs are setting the foundations for the continuing digitization of FSI

- – What to expect as the data market becomes further regulated…

Learn from top FSI/Regulatory expertise from Asia & Europe!

Speaker lineup:

• Kalliopi Spyridaki Chief Privacy Strategist, Europe & Asia Pacific, SAS | Brussels

• Davide Corda Senior Director , Group Data Office, Intesa Sanpaolo | Milano

• David Hardoon Senior Advisor for Data and Artificial Intelligence, UnionBank Philippines | Singapore

• Zee Kin Yeong Deputy Commissioner at Personal Data Protection Commission (PDPC) | Singapore

• Vishal V Patil Head of Data and Analytics Compliance Transformation, Citibank | Singapore

• Michael Salmony Executive Advisor equensWorldline | Frankfurt (Moderator)

Organized by

Supported by

APC Webinar Series

Insurtech for Non-Life Insurers: Challenges, Risks & Data Privacy

Wednesday, 28/10/2020

9:30 a.m. - 12:00 p.m. (Hong Kong time)

Challenges to Non-Life Insurers

Speaker: Diamond Lo

- 2019/2020 market development, including new players

- Business values in introducing Insurtech

- Common obstacles faced by insurers

Insurtech - IT Security

Speaker: Henrique Centieiro

- The challenges, opportunities and risks that ABCD (AI, Blockchain, Cloud and Data Analytics) technologies bring to Insurtech

- How to leverage cloud and technologies such as Blockchain and Data Analytics without compromising IT security?

- What are the best IT security practices in the industry?

Insurtech & Data Privacy

Speaker: Henry Wong

- Introduction

- Key sanctions for breaches

- Potential vulnerabilities

- Hong Kong and UK judgments

- Food for thoughts

Mr Diamond Lo

Former CEO of Macau Insurance Company

Mr Henrique Centieiro

Innovation Project Manager

Henry Wong

Founding Partner of WMC Partners

MII Webinar Series

Delighting Your Customers and Finding New Prospects DIGITALLY

Tuesday, 18/8/2020

10.00 a.m. - 12.00 p.m.

2 hours (including Pre & Post Assessments)

Outline- Keeping your pipeline full: Make a prospecting action plan your priority

- Prospecting online by creating social media presence

- The power of framing to gain instant credibility without physical meet up

- Building rapport and trust over without physical meet up

- Turning prospects into customers

By the end of this session, participants will be able to:

- Recognise potential ways to improve customers’ interaction through digital resources

- Discuss the methods or techniques to strengthen sales and relationship skills with existing and new prospects

- Describe the tools and action plans in digital and social media marketing execution

- Demonstrate through digital resources how one is able to build rapport and turn prospects into customers

Price: MYR 350

*Fee is not inclusive of 6% SST

Michael Teoh

CEO & Founder of Thriving Talents

SIDC Webinar

Digital Insurance in Malaysia

Tuesday, 18/8/2020

Join us for this 75 minute webinar to discover the digital insurance landscape in Malaysia in partnership with the Malaysian Insurance Institute (MII)

Event Highlights

Key Questions to be answered:

| 1. What are the key global trends on digital insurance? |

| 2. What is the InsurTech landscape in Malaysia? |

| 3. How quickly are ecosystems building ? |

| 4. How to create effective partnerships |

| 5. How are existing insurers reacting? |

The Digital Insurer Webinar Series

Cyber Resilience in the Financial Sector - Preparing for the Covid Cyber Storm

Tuesday, 12/8/2020

7:00 p.m. - 8:00 p.m. CST

The impact of Covid-19 (C19) on cyber risk is like a confluence of forces producing the ideal conditions for a cyber related storm that could impact critical functions and industry ecosystems. The global economy is in chaos, dealing with an unprecedented crisis affecting all supply chains and literally transforming society. Cyber threat actors have taken advantage of this “opportunity” with International, European and National law enforcement agencies reporting huge increases in cybercrime and fraud related activity.

It’s a new era and as we endeavour to “rebound” into a new normal, we have to be cognisant of a number of facts. Operational models have changed and therefore the cyber related risks have too. Our new greater reliance on the Internet, the digital economy and digital architecture is reflected in a new supply chain. The ubiquitous adoption of remote access technologies to enable WFH (Work from Home) practices often deployed on residential networks and personal devices perhaps did not always follow the normal assurances of enforced policies. The reality today, is that the “pre-Covid-19 cyber strategy” may not be aligned with the new business model of today.

As we deal with this “C19 Cyber Storm” we enter the “new normal” it is an imperative for boards to make risk informed decisions. They need to reassess the digital dependencies of their organisation and risks accrued to restore their risk profile to an acceptable level.

Join Paul C Dwyer, president of the ICTTF - International Cyber Threat Task Force as he outlines the challenges facing organisation’s and the 10 key steps they can take to transition to the “new normal”. This webinar will showcase content from the CCRO Certified Cyber Risk Officer course delivered in partnership with the ICA.

Join Paul C Dwyer,

president of the ICTTF

ICA Webinar Series

Win With Agile Innovation in a Changing World

Wednesday, 29/7/2020

09:00 British Summer Time

People’s behaviour and attitudes are evolving faster than ever before. New rituals and habits are emerging and transforming the way people engage with and use products and services.

Fast growing businesses have one thing in common. They innovate with speed and agility. And this is even more important following times of change when innovation needs to fuel recovery in the short term, as well as drive growth in the long term.

Join our webinar to discover five tips for recovery and growth through innovation. Our experts discuss the opportunities a changing world brings for innovators. How to assess your current innovation portfolio and pipeline and plan for the medium and long term. We’re excited to show how our new innovation suite on Kantar Marketplace can help accelerate your innovation journey through recovery and beyond.

There is no better time to innovate. Register now.

Dr Nicki Morley

Lead Innovation Consultant

Simon Duval Kieffer

Global IPD Business Development and Expertise

Leila Buckley

Head of activation, Kantar Marketplace

KANTAR Webinar Series

The Now, New, and Next Normal: Digitization in a Post COVID-19 World

Wednesday, 29/7/2020

9:30 a.m. Hong Kong (GMT+8)

COVID-19 did not dramatically change digital strategies and digital transformations across our industries, it only served to accelerate them. What can we expect in a post COVID-19 world? How will the way we run our operations change? What are the event horizon technology advances we need to be aware? We may not have all the answers, but the ones we do have will surface questions that we aren’t asking today.

Registration is being offered at no cost to both members and nonmembers of LIMRA and LOMA, and senior insurance executives as well as agency owners and managers are encouraged to attend.

Kartik Sakthivel

Chief Information Officer, LIMRA, LOMA and LL Global

LIMRA. LOMA. SRI Webinar Series

Focus on Digital Innovation, eKYC & AML (Malaysia & APAC)

Monday, 27/7/2020

5:00 p.m. to 6:30 p.m. (MYT/SGT)

The recent release of Bank Negara Malaysia (BNM)'s policy announcement on their policy on eKYC (electronic know your customer) is one of the crucial elements for digital banking players keen on shaping and taking the lead in the neobank/digitalbank area. This new policy will immediately impact all financial institutions including banks, insurers, money changers and remittance companies. Policy documents also highlight the use of additional technologies like video calls, AI and machine learning tech to assist with performing eKYC verifications. As this conversation continues to expand, one significant area where eKYC will have a significant impact will be on curbing Anti Money Laundering (AML) by increasing personal privacy, increasing security, managing regulatory coordination, improve data protection and financial inclusion.

What can Malaysia learn from neighboring countries a little ahead of the curve like Singapore, Korea, Hong Kong and the Philippines?

What other innovations can be implemented to leapfrog ahead from the mistakes made by others?

In this Webinar, we explore what's worked, what hasn't and review what players in Malaysia and APAC are doing to balance technology advancements with regulatory controls.

Charmayne Chung

Head Strategic Digital Alliances

Maybank

Robin Lee

Vice President (APAC)

Napier AI

Frederic Ho

Vice President (APAC)

Jumio

Data Breaches: Are You Ready?

Thursday, 23/7/2020

10.00 a.m. - 12.00 p.m.

2 hours (including Pre & Post Assessments)

OutlinePersonal Data: Why Protect it?

- What is personal data and why protect it?

- Identifying sensitive data

- Legislation and guidelines on data protection

What is Data Privacy and What You Need to Know

- Privacy vs. data protection

- How safe and secure is your data?

- Why do data breaches happen and the cost of privacy breaches (financial, reputation, resources etc)

Safeguarding Data Privacy at the Workplace and Data Breach Management

- Potential causes of data privacy breaches and the red flags

- Protection of assets and data security policy

- Workplace practices and culture

- Data breach monitoring, management plan and responding to data breaches

- Case study: Recent data breaches and lessons learned

- Updates and development in data privacy

By the end of this session, participants will be able to:

- Explain why data privacy and protecting data is important

- Recognise the relevant data privacy laws and regulations and its expectations

- Explain the risks of failing to protect privacy on individual and organisational level

- Describe the potential data privacy breaches and red flags in business organisations

- Examine employees’ roles and responsibilities in relation to data privacy

- Discuss how to prepare and deal with data breaches

Price: MYR 350

*Fee is not inclusive of 6% SST

SIDC Webinar

Accelerating Digital Workforce Transformation in Financial Services

Thursday, 23/7/2020

10:00 a.m. – 11:00 a.m.

The rise of digital disruption has progressively paved the way for the development of ground-breaking technologies, which have transformed the banking ecosystem and brought vast improvements to the customer experience. However, the full benefits of digital innovation can only be reaped by a digitally proficient workforce, and today’s competitive environment necessitates the creation of a sustainable talent pool with the right technical skills, strong digital expertise and the agility to adopt new ways of thinking.

The COVID-19 pandemic has also heightened the urgency to digitalise the financial services industry, forcing banks to re-examine their readiness to adapt, innovate, and adopt flexible work arrangements to stay connected with and provide an engaging experience for increasingly sophisticated customers.

“Accelerating Digital Workforce Transformation in Financial Services”

In this session, our panel of speakers will discuss the importance of digitally empowering the banking workforce, and address the challenges and concerns faced by banks that are looking to lay a strong foundation for developing a sustainable and digitally able talent pool. Discover how the banking workforce can digitally up-skill, develop new competencies and adopt new technologies, all of which are strategies crucial to ensuring that the banking industry remains relevant, attuned to changing customer expectations, and ultimately, capable of thriving in the new normal.

Fee: Complimentary

Speaker:

Datuk Nora Manaf, CB

Group Chief, Human Capital Officer

Maybank Group

Jasmin Peters

Director, Experience Consulting Lead

PwC Malaysia

Kwan-Sek Lim

Director, People and Organisation

PwC Malaysia

Prasad Padmanaban

Chief Executive, AICB

Datuk Nora Manaf, CB

Group Chief

Human Capital Officer

Maybank Group

Jasmin Peters

Director, Experience Consulting Lead

PwC Malaysia

Kwan-Sek Lim

Director, People and Organisation

PwC Malaysia

Prasad Padmanaban

Chief Executive, AICB

AICB’S Empowering Bankers

Webinar Digital Banking Series

Supported by

AICB’S Empowering Bankers

Webinar Digital Banking Series

How will Covid-19 Change the Outlook for ESG

Tuesday, 30/6/2020

10:00 a.m. – 11:30 a.m.

Outline

The New ESG: How will Covid-19 change the outlook for ESG?

- Can organisations stay committed to ESG principles under challenging business conditions?

- Will ESG initiatives take a back seat or become a lever to support organizations as they rebound from Covid-19 pandemic?

- Opportunities for investment innovation in incorporating ESG factors vis-à-vis climate and sustainable investment

- Will the upcoming Pandemic Emergency Facility 2.0 (World Bank) align with ESG elements?

Learning Outcomes

By the end of this session, participants will be able to:

- Describe the ESG principles

- Discuss the potential ESG initiatives taken by organsiations in managing Covid-19 impact

- Analyse the available and potential opportunities in incorporating ESG in investment innovations

- Discuss how the investment package/facility could be aligned with ESG principles

Faroze Nadar

Executive Director, Global Compact Malaysia Network

Dr. Keith Lee

Senior Vice President, WWF Asia Sustainable Finance

Promod Dass

Deputy Group CEO of RAM and CEO of RAM Sustainability

SIDC Webinar

Driving Digital Transformation in Least Developed Countries (LDCs)

Wednesday, 24/6/2020

9.30 a.m. New York Time | 1.30 p.m. GMT

Digital technologies and services are playing a critical role in mitigating and navigating the significant impacts of COVID-19. In least developed countries (LDCs) in particular, the pandemic is spurring the need to leverage digital solutions to support the responses to the crisis.

The question to consider is:

How does digital transformation define the response to COVID-19 while preparing the foundation to build inclusive digital economies that will support sustainable development in the future?

UNCDF will share its strategy and experience in building inclusive digital economies in LDCs with the public and private sector. The webinar aims to give participants an understanding of the types of partnerships and initiatives that drive the digital transformation in the last mile in LDCs.

Stakeholders from both the public and private sector will be present to share their insights and perspectives regarding digital transformation and how it contributes tothe response to the COVID-19 crisis and beyond.

Judith Karl

UNCDF

Henri Dommel

UNCDF

Judith Nabakooba

Minister of ICT Uganda

Sabine Mensah

UNCDF

Bettina Etter

Swiss Agency for Development and Cooperation

Omar Cisse

Intouch Senegal

UNCDF Webinar

Managing Cyber Risks in the Current Crisis

Thursday, 28/5/2020

3.00 p.m. - 5.00 p.m. (Singapore Time)

With everyone working from home with the lockdown, everyone has suddenly gone digital.

There is an almost instant adoption of work-from-home technologies. With this hype on going digital rapidly in the lockdown using customer-facing networks and apps, the ugly face of the threat of cyber risks rises dramatically. And there are hackers aplenty with attackers ready to exploit the gaps.

Are you cyber protected? Is your business adapting quickly enough to cover these additional risks?

Recovery, Renewal, Resilience:

A Game Changer Strategy Post-Crisis

Thursday, 21 May 2020

9.00 a.m. - 12 p.m. (MYT)

Join us at this interactive Online Facilitated Workshop with Professor Dennis Campbel from Harvard Business School. This workshop is catered for for Senior Management and Board Members.

Fee: RM2,500 RM2,375 per person (exclusive for MII members)

Speaker Profile

He wrote the Handelsbanken case on one of the world’s most profitable banks. He has written several financial services cases in addition to Handelsbanken. These include Wells Fargo, Affinity Plus, information intermediaries like Chex Systems and few more He also done extensive research and data analytics on customer channel preferences and behaviour in banking as well as alternative bank lending models.

He leads the Centre for Organizational Entrepreneurship for Filene Research Institute (they are a think tank for cooperative financial institutions). In that centre they conduct research and writing on service, product, and delivery channel innovation in financial services.

Dennis Campbell Dwight P. Robinson

Jr. Professor of Business Administration

Unit Head, Accounting and Management

Harvard Business School

The Malaysian Insurance Institute (MII)

in collaboration with CADS

The best CX strategy in times of crisis is human-centric: Rethinking CX to be ready for bounce back

Monday, 18/5/2020

Despite the doom and gloom of 2020, some brands are succeeding at creating positive moments for people. Join us in our CX webinar where our Kantar CX experts discuss the foundation of human understanding, understanding how a shift in mindset towards long-term human centricity is vital as they persevere.

Watch the recorded session

KANTAR Web Series

The CX silver lining for businesses: renewed brand purpose as an opportunity to build customer trust

Tuesday, 12/5/2020

2.00 pm (SGT)

Brands can do good by doing well. By aligning what the brand stands for with how it is experienced by customers, businesses have the opportunity to earn trust.

Brands that stay relevant and authentic, are able to demonstrate great responsibility for society in these troubling times.

KANTAR Web Series

Implementing Digital Learning in the Workplace

Tuesday, 5/5/2020

2.00pm - 3.00pm

Last week The Malaysian Institute of Management in Collaboration with Elementrix launched the Digital Learning in Asia (Malaysia and Singapore) 2020. The survey identified that organisations do not know how to implement digital learning. The result is a lot of wasted time and money.

Join us on this 60 minute webinar to learn from the experts on how to become successful in a world of digital learning. Our special guest is Edmund Lai, CEO of Learning Gym, one of China’s leading digital learning companies.

At this webinar, you will learn about a 5 step framework to plan and develop digital learning, the 6 stages of digital transformation, 10 learner behaviour trends, an example of how to implement digital learning, and more.

Edmund Lai

CEO of Learning Gym,

one of China’s leading digital

learning companies.

Webinar Series supported by

The best CX strategy in times of crisis is human-centric

Tuesday, 5/5/2020

2.00 pm (Singapore Time)

Despite the doom and gloom of 2020, some brands are succeeding at creating positive moments for people.

To find out how, this webinar will go back to the foundation of human understanding, to see how a shift in mindset towards long-term human centricity is vital for brands to grow.

KANTAR Web Series

AI led innovation at scale: How Digital Insurers are leading the way

Tuesday, 28/4/2020

3.00 pm - 4.00 pm

This webinar will showcase how Global Insurance majors are leveraging Artificial Intelligence (AI) powered Analytics to drive forward their Digital Transformation journeys. With ongoing uncertainties presented by the Covid-19 situation, it has become even more important for Insurers to further embed Data driven decision making at the core of their processes. The ‘new normal’ world for Insurance players would require them to improve Operational effectiveness, drive further Digital enablement and achieve higher Customer engagement. Aided by actual client implementations led by BRIDGEi2i, we will share in this webinar how we were able to drive sustainable business growth in areas such CRM/Marketing, Claims Management & Fraud, Underwriting & Pricing etc.

Audience to be targeted:

CXO / Functional heads from: Digital, Analytics, Claims, Sales / Marketing, Underwriting, Actuarial / Pricing, Business / Line of Business heads

Dato’ Tharuma Rajah’s Bio

Dato’ Tharuma Rajah is the Founder & CEO of Garage Analytics – a digital consulting firm. He was formerly President of Korn Ferry Hay Group Asia Pacific. Prior to that, Managing Director of Hay Group Fast Growing Markets. He has advised clients globally across public and private sectors on a challenging mix of strategic people, leadership and organizational issues. He is a Board Member for Finance Accreditation Agency Malaysia (FAA) and The Center of Applied Data Science (CADS). He is also an Executive Coach and the co-author of ‘The Indian CEO: A Portrait of Excellence’.

Dhritiman Chakrabarthi’s Bio

Dhritiman Chakrabarti is an Advisor with BRIDGEi2i Analytics Solutions, with 20+ Years of experience in Management Consulting. In his last role, he was a Senior Partner and Regional Solutions Leader (APAC) at a leading Advisory Company.

Most of his client work has focused on Integrated solutions, that bring together combinations of Analytics, Strategy, Design, Implementation & Technology enablement. Key industries recently worked with include, Banking, Development finance institutions (DFIs), Diversified conglomerates, Government, Insurance, and ICT (Information, Communication & Technology)

Watch the recorded session

Dato’ Tharuma Rajah

Founder & CEO,

Garage Analytics

Dhritiman Chakrabarti

Advisor, BRIDGEi2i

The Malaysian Insurance Institute (MII)

in collaboration with CADS

Define A Way Forward – Futureproof for Sustainability

Monday, 27/4/2020

3.00 pm - 4.00 pm

Being future-proof often relies on a business’s ability to adapt yet innovate, especially during a challenging market environment. Thinking strategically and taking a broader, deeper, more rigorous approach to futureproofing can create agility and focus, both in the way leaders respond to risks and the way leaders innovate to capitalize on opportunities.

In a webinar presented by Malaysian Insurance Institute (MII) together with The Center of Applied Data Science (CADS), Technical Director Dr Stamatis Kourtis will guide leaders to overcome present-day disruptions and beyond through forward-thinking approaches in workforce remodelling, data literacy and talent acquisition.

Indeed, innovation around sustainability can provide a new competitive advantage at three possible levels: products, processes and business models.

Dr Stamatis Kourtis is a technology expert with 20 years of experience. Throughout his career, he has been utilizing data analytics to gain actionable insights that assist customers in decision-making across different industries and business functions. He holds a PhD from University of Surrey and an MBA from Warwick Business School at the University of Warwick in UK.

Watch the recorded session

Dr Stamatis Kourtis

Technical Director

The Malaysian Insurance Institute (MII)

in collaboration with CADS

Actualize Data Driven Success Through Alignment

Friday, 24/4/2020

3.00 pm - 4.00 pm

The age of digital transformation is unstoppable. Being ready for change means staying ahead of the curve and to achieve this, leaders have to benchmark organization data maturity level against best practices to identify key strategic initiatives towards becoming a Data Driven Organization.

Mr. Chari TVT will demonstrate through a webinar how to align organizations with a data-driven strategy and become a Data Driven Organization with effective culture and processes to drive business growth. The webinar will be presented by Malaysian Insurance Institute (MII) together with The Center of Applied Data Science (CADS).

Whether its market disruptions, new business objectives, or employee demands, staying agile in these moments will set you up for success.

Mr. Chari TVT is a senior finance professional (retired CFO) with over 39 years of experience in the Technology and Telecom sectors across Asia Pacific in leading cultural change, building cross-functional leadership teams & organizational capabilities. He has overseen successful strategic organizational transformations and received external recognition for the highest profits and returns in the industry. He currently serves as a consultant and financial advisor.

Watch the recorded session

Mr. Chari TVT

a senior finance professional (retired CFO)

The Malaysian Insurance Institute (MII)

in collaboration with CADS

Turning Crisis into Opportunity: Emerging Stronger Post-Covid-19 with Prof. Dennis Campbell from Harvard Business School

Tuesday & Wednesday, 21 & 22 April 2020

9.00am – 12.00pm ( MYT)

The year 2020 began with the Covid-19 global crisis, forcing unprecedented change upon leaders to manoeuvre into a new norm within their organizations. Insurers are being challenged to review and update their crisis management plans and take steps to continue operations with minimum disruption to clients. Balancing the need for responding to this influx of activity in centres with a remote workforce has to be addressed. During a major crisis like this, insurers should start preparing for the future by accelerating the digitization of their operations and planning for business opportunities ahead by quickly embracing the new “Data Driven Culture”. Unfortunately, only 8 out of 10 companies found that business adoption of Big Data and AI initiatives remains a major challenge. How can organizations quickly learn and adopt key drivers in Digital Transformation from similar financial intermediaries such as traditional banks ?

Why should you attend ?

As the coronavirus infects the global economy to the point of virtual shutdown, daily predictions of GDP decline are getting worse by the day. Predictions that the world’s output could decline by at least 25% might be optimistic. International Labour Org, a UN agency, predicts the impact could see 195 million job losses.

Insurance companies play a pivotal role during times of economic stress by helping companies and households manage risks and cushion against losses. It is critical to understand the potential impacts to the business—such as those from loss of life and health-impacted insureds—to being able to manage shifting liabilities and assets, interruptions to supply chains and potential litigation. There is an opportunity to re-evaluate how technology, insight and analytics can accelerate the future growth and competitiveness of insurance institutions. To move forward will require a new perspective from most C-suites regarding priorities, deployment of resources and futureproofing the workforce.

Speaker Profile

He wrote the Handelsbanken case on one of the world’s most profitable banks. He has written several financial services cases in addition to Handelsbanken. These include Wells Fargo, Affinity Plus, information intermediaries like Chex Systems and few more He also done extensive research and data analytics on customer channel preferences and behaviour in banking as well as alternative bank lending models.

He leads the Centre for Organizational Entrepreneurship for Filene Research Institute (they are a think tank for cooperative financial institutions). In that centre they conduct research and writing on service, product, and delivery channel innovation in financial services.

Dennis Campbell Dwight P. Robinson

Jr. Professor of Business Administration

Unit Head, Accounting and Management

Harvard Business School

The Malaysian Insurance Institute (MII)

in collaboration with CADS

Bridge The Human-Digital Divide

Monday, 20/4/2020

2.00 pm - 3.00 pm

Technology has transformed the way people work. Leaders can resolidify their teams by developing a robust Workforce Augmented Strategy to adjust their leadership behaviour, embrace digital workforce platforms and deepen their engagement with digitally enabled workers.

Malaysian Insurance Institute (MII) together with The Center of Applied Data Science (CADS) Founder and CEO Sharala Axryd will run a webinar for leaders to create a center of excellence for data literacy that addresses business needs and talent potential identification.

In doing so, leaders will be able to:

- improve employee engagement and talent retention

- improve data literacy and close competency gap

- digitize operations and automate process

With over 15 years of experience in the telecommunications field, award-winning entrepreneur Ms Sharala Axryd established The Center of Applied Data Science (CADS) as a platform for data, analytics and artificial intelligence in workforce transformation solutions. She also brought The Data Incubator and Harvard Business School programmes to Malaysia and launched ASEAN’s first data science accelerator program.

Watch the recorded session

Ms Sharala Axryd

Founder and CEO,

The Center of Applied Data Science (CADS)

The Malaysian Insurance Institute (MII)

in collaboration with CADS

Review Competitive Strategies using AI: A Board’s Perspective

Tuesday, 7/4/2020

2.00pm - 3.00pm

No board can fulfil its oversight duties without considering artificial intelligence (AI) and its potential to transform and disrupt strategy. AI’s potential value is enormous. According to a study of 16 industries by Accenture, AI is capable of increasing profitability rates by an average of 38% and add trillions of dollars in gross value by 2035.

To reap that value, companies are starting to compete using AI by disrupting industries with new business models. They have to simultaneously raise and serve customer expectations and partner with technically advanced ecosystem partners. It is timely for directors to perform both an inward and outward evaluation - reviewing their own knowledge and their company’s activities, as well as appraising the use of AI beyond the walls of the boardroom and the company.

This webinar will help boards and directors independently evaluate and guide management in using AI to advance their company’s strategy in a responsible way, providing them with frameworks and questions to assess their understanding of AI & their company’s future AI activities.

Watch the recorded session

M. Nazri Muhd

ICDM Faculty and

President/CEO, MyFinB, Singapore

ICDM Web Series